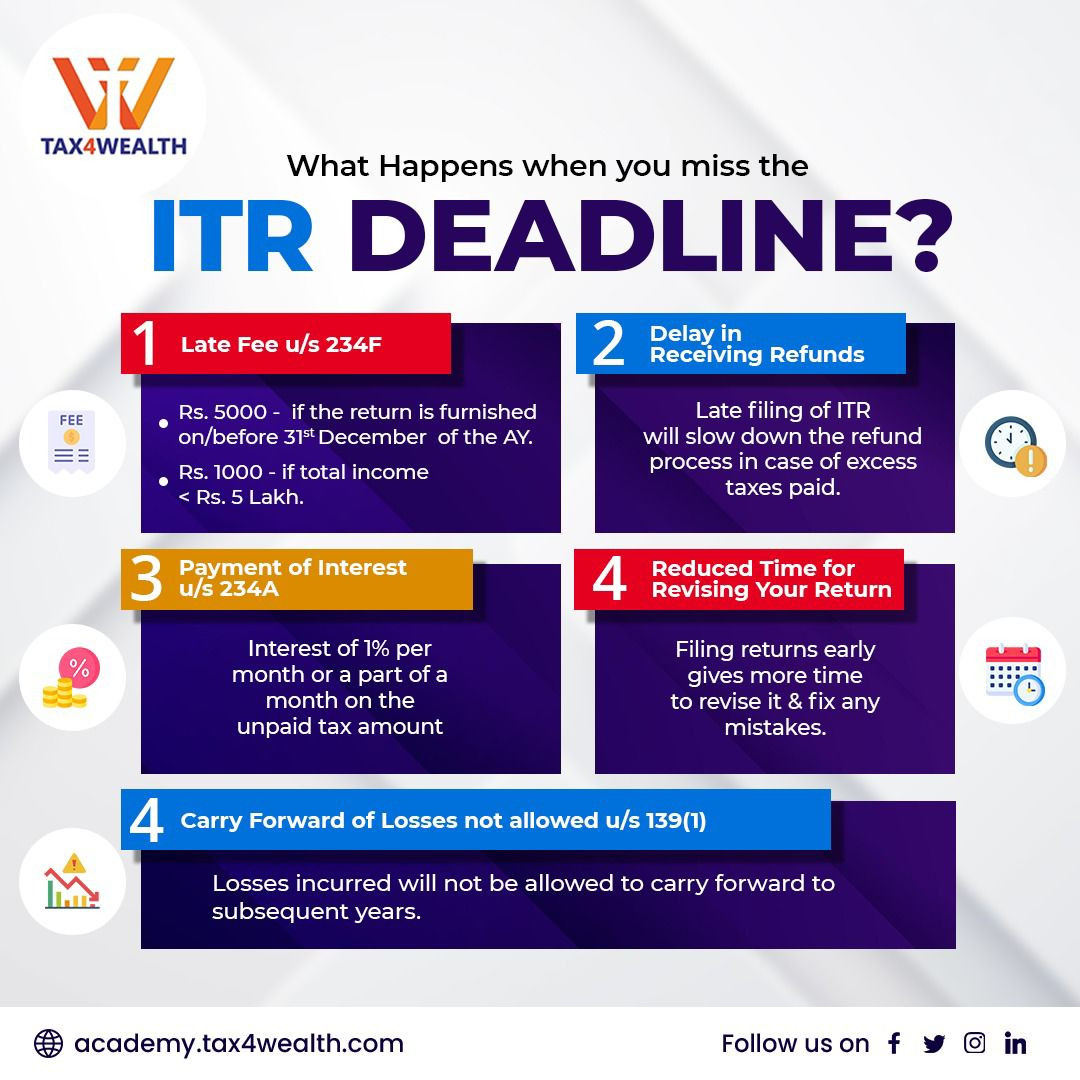

What are The Consequences of Missing The ITR Deadline?

If you miss the ITR deadline, you may be subject to the following penalties:-

✅ Late filing fee

A late filing fee of Rs. 5,000 will be imposed if you are filing ITR after the due date. However, if your total income does not exceed Rs. 5 lakh, the late fee will be limited to Rs. 1,000

✅ Delay in refunds

In the case of late filing of the return, the process of refund will be delayed if the taxes are paid in excess.

✅ Lesser time to revise the returns

If you file your ITR early, you will have more time to revise and fix any mistakes.

✅ Carry Forward of losses not allowed

As per section 139 (1), Losses incurred will not be allowed to carry forward to subsequent years.

✅ Penal interest

If you owe any tax, you will be liable to pay penal interest on the outstanding amount from the due date of filing the return. The penal interest rate is 1% per month or part of a month under section 234A.

✅ Prosecution

In some instances, you may also be prosecuted for failing to file your return. However, prosecution is usually only initiated if the amount of tax evaded is significant.

You can still file your return after the due date, but you must pay the late filing fee and any applicable penal interest. You can file your return up to three months before the end of the relevant assessment year.

Here are The Steps on How to File a Belated ITR:-

1. Go to the Income Tax Department website

2. Click on the "e-filing" tab.

3. Click on the "Belated ITR" link.

4. Select the relevant assessment year.

5. Enter your PAN and password.

6. Fill out the belated ITR form.

7. Pay the late filing fee.

8. Submit the form.

For more update of ITR, Visit us at: https://academy.tax4wealth.com/blog

No comments yet, Be the first to comment.